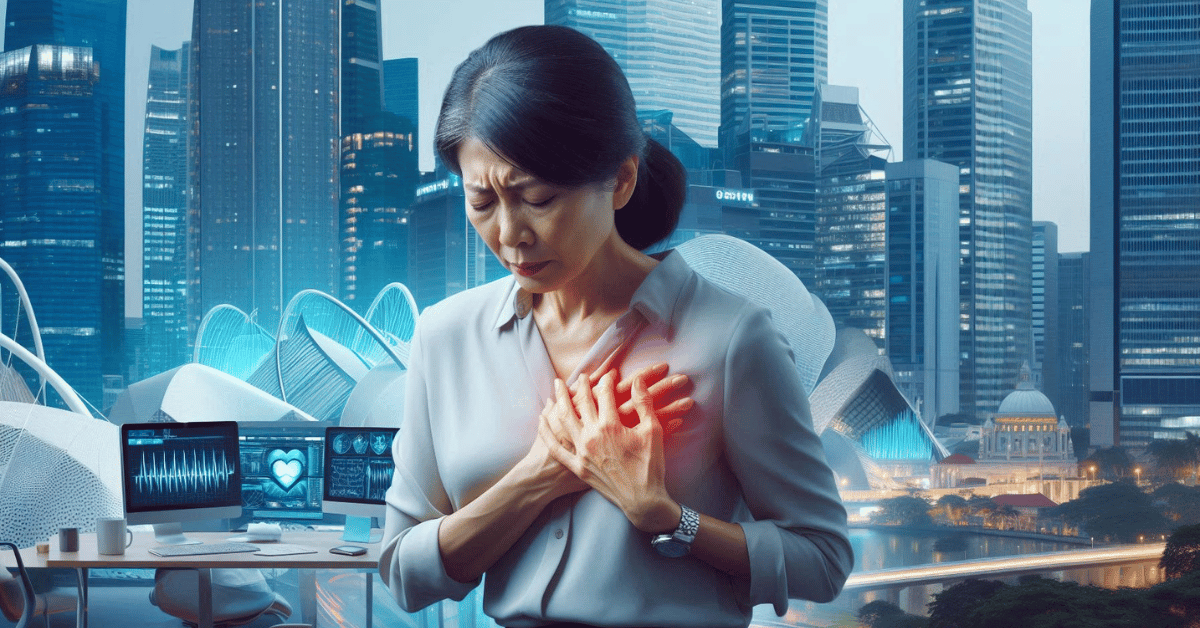

Tan Meiling, 47, wasn’t the type to slow down. As a finance executive working in a mid-sized firm in Singapore’s CBD, her days were filled with deadlines, strategy meetings, and the occasional late-night client call. Outside of work, she was also the main caregiver for her older parents, juggling appointments, groceries, and household needs with practiced efficiency. Meiling’s journey was one of constant motion, balancing professional demands with personal responsibilities.

So when she started feeling more tired than usual and occasionally breathless climbing stairs, she chalked it up to stress. That changed one weekday morning, when she felt a tight, pressing discomfort in her chest while walking out of a client’s office.

“It wasn’t unbearable,” she recalled. “But it lingered, like something wasn’t right.”

She rested for a bit and the feeling faded. But something in her gut told her to act. She booked a same-day visit with her regular GP, who, after a quick ECG, advised her to see a cardiologist urgently.

Thankfully, Meiling had already purchased PRUShield and PRUExtra Preferred CoPay a few years ago after a close friend’s health scare. Her GP reminded her to choose a Prudential panel specialist, so her treatment would be eligible for PRUPanel Connect benefits—a choice that would later save her both time and money.

A Quick Turnaround with a Panel Cardiologist

The next day, Meiling saw a Prudential panel cardiologist at a reputable private hospital. The clinic staff helped verify her insurance eligibility and assured her that many of the costs would be covered, as long as the required eFiling was done through the hospital’s business office.

The consultation was thorough. The specialist listened carefully, reviewed her ECG results, and scheduled additional tests—a treadmill stress test and a cardiac CT scan. The results showed signs of early-stage coronary artery narrowing. While not yet critical, it posed a future risk and required intervention.

The doctor recommended a minimally invasive stenting procedure, done as a day surgery, to restore proper blood flow. This would prevent a potentially serious cardiac event down the road.

Although overwhelmed at first, Meiling felt reassured. The clinic handled the pre-authorization process, and the hospital’s admin team confirmed that the entire procedure, including specialist fees, use of facilities, and follow-up consultations, was largely claimable under her PRUShield plan.

She only had to co-pay a small, capped percentage thanks to her PRUExtra coverage, which covered the rest.

“Knowing that I didn’t have to fork out a five-figure sum upfront gave me peace of mind,” she later shared. “The hospital staff took care of the paperwork, so I could just focus on getting better.”

The Procedure and a Smoother Recovery

The surgery went smoothly. Meiling was admitted in the morning, had the procedure completed within a few hours, and was discharged the next day after overnight monitoring. Her Prudential panel cardiologist checked in with her twice during her stay.

In total, the bill came up to just under $18,000, but because the hospital was part of Prudential’s PRUPanel Connect network, and the doctor was a panel specialist, the claim was eFiled directly through the hospital’s system. Meiling only had to co-pay a small amount, and there were no delays in processing.

The coverage also included pre- and post-hospitalisation consultations, which made her follow-up care more affordable.

Returning to Normal, with a New Outlook

Meiling took two weeks off to recover fully and ease back into her routine. She adjusted her lifestyle—eating healthier, walking daily, and managing her stress levels more intentionally.

With continued follow-ups scheduled every three months and her insurance benefits still active, Meiling felt supported. She even met with her Prudential financial consultant afterward to review her plan and ensure that her coverage would grow with her health needs.

“I used to think insurance was just for worst-case scenarios,” Meiling reflected. “But now I see how it supports you in real, everyday ways. It’s not just the money—it’s the ease and speed it gives you when you’re at your most vulnerable.”

Why Meiling’s Journey Matters

In Singapore, healthcare is top-tier, but private treatment can be costly without the right support. Meiling’s case shows how planning ahead with the right insurance plan, and choosing the right panel doctor, can make a serious diagnosis easier to handle, both financially and emotionally.

With PRUShield and PRUExtra plans, policyholders can access:

- Private specialists under PRUPanel Connect

- Cashless treatments at approved hospitals and clinics

- Minimal out-of-pocket costs when pre-authorized and eFiled

- Coverage for tests, surgery, and follow-ups

By choosing a Prudential panel cardiologist, Meiling received timely care without the burden of financial stress. Her journey is a reminder that having health insurance isn’t just about protection — it’s about access and confidence when it matters most.

If you or your loved one is going through a medical condition, it’s better to speak with a financial consultant to understand your options. For our readers’ assistance, we’ve listed our preferred financial consultant below.

Melissa Mok – Master Financial Consultant In Singapore

Melissa prides herself as an educator and facilitator for her clients.

Disclaimer: 365Asia aims to provide accurate and up-to-date information, our contents do not constitute medical or any professional advice. If medical advice is required, please consult a licensed healthcare professional.