Melissa Mok

Master Financial Consultant

Thinking of doing a health screening, breast cancer mammogram, ultrasound, or other medical imaging? Speak to Melissa on your medical insurance coverage.

About Melissa Mok

Melissa Mok began her financial consultancy journey in 2015 while studying business at NUS. Since then, she has helped over 450 clients build personalized financial plans, many of which have evolved into lasting friendships. For Melissa, financial planning goes beyond numbers; it empowers individuals to achieve their life goals with confidence and clarity. As both an educator and guide, she offers clear, tailored solutions to support her clients at every step of their financial journey.

What Is Melissa’s Ethos In Financial Consultancy?

If You Run Into Melissa Mok Outside Work, You Are Likely To…

Catch her spending quality time at the park with her dog Toto or on her way to a pilates class.

10 Frequently Asked Questions About Dr Henry Tan Chor Lip

I was inspired by a mix of personal experiences and a strong desire to help others achieve financial stability. Seeing the behind-the-scenes work in claims, portfolio servicing, and planning made me realise how important my role is in supporting clients’ financial goals. My love for numbers and problem-solving fits well with the analytical side of this career, allowing me to make a real difference by offering sound financial advice and ensuring clients have the right insurance coverage.

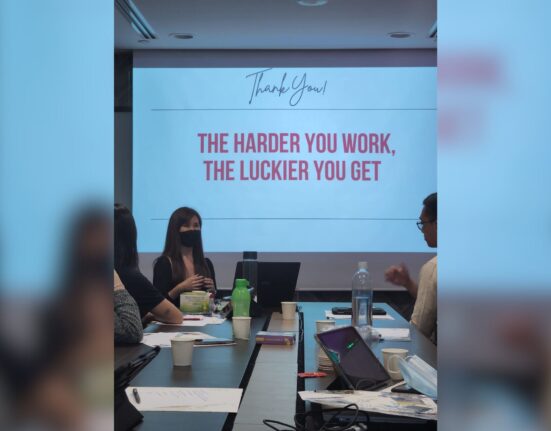

I believe in building strong, trust-based relationships by always putting my clients’ best interests first. My approach is to offer clear, honest, and unbiased advice, helping clients fully understand their options and the impact of their choices. My goal is to guide them in creating a clear long-term financial plan and to support them in making adjustments as life evolves.

I actively pursue professional development through courses and certifications to stay current with industry trends, regulations, and best practices. At the same time, I make it a priority to understand each client’s unique needs and provide tailored solutions instead of a one-size-fits-all approach.

I always encourage open communication and ask clarifying questions to ensure I have a clear understanding of their financial situation and objectives. Additionally, I make it a priority to schedule regular reviews to update the client’s information. This allows me to adjust their financial plan or insurance coverage as needed, ensuring they remain on track to meet their goals.

I provide updates on changes in health insurance regulations and new plan offerings. Additionally, I conduct regularly scheduled workshops and webinars to educate clients about health insurance and offer comprehensive guides and articles on different types of health insurance, coverage options, and common terms.

I make sure to advocate on behalf of the client with insurance providers, and collaborate with other experts, such as legal advisors or medical professionals, when necessary, to ensure comprehensive advice.

One example that stands out involves a client who faced a severe and unique medical emergency that was traced back to a congenital illness. The client’s initial claim was denied due to a misunderstanding of their policy’s coverage terms. After reviewing the policy in detail and identifying the coverage clause that applied to the situation, I coordinated with the client’s healthcare provider to gather all necessary documentation and submitted a comprehensive appeal to the insurance company. Throughout the process, I kept the client informed and provided emotional support whenever possible. Thankfully, the appeal was successful, and the client received full coverage for their medical expenses, alleviating significant financial stress during a challenging time.

Accordion ContenSome clients think they don’t need insurance because they are young and healthy, which is absolutely not true. Therefore, I make it a point to remind them of the possibilities of unexpected accidents or illnesses and the financial protection health insurance provides. Additionally, some believe insurance is too expensive. In that case, I always help them understand that there are affordable options available and remind them that the cost of not having insurance can be much higher in the event of a medical emergency.t

Not considering potential future health needs and selecting the cheapest plan without considering the coverage and benefits are common mistakes that can be avoided. For these instances, I always encourage clients to think long-term and choose plans that can accommodate changes in their health status.

I advise being fully aware of what your policy covers and any associated costs, such as copayments and coinsurance, to avoid unexpected expenses. Additionally, I recommend regularly reviewing your insurance coverage and making adjustments based on changes in your health or financial situation. Taking advantage of preventive services covered by your insurance or company, such as annual check-ups and screenings, can help catch health issues early.

The Vision

One Size Doesn’t

Fit All

Fit All

When it comes to financial planning, we all have our own objectives and financial situations. I aim to provide the recommendations that best fits my client’s needs.

-Melissa Mok

Expert opinion

Disclaimer: 365Asia aims to provide accurate and up-to-date information, our contents do not constitute medical or any professional advice. If medical advice is required, please consult a licensed healthcare professional.